LCredit loan app is an app that allows you to access quick loans, and CASHIGO INTERNATIONAL provides it. This loan provider is one of the best for accessing loans quickly, and the platform is safe and secure.

LCredit has been around for quite some time, and Nigerians widely use this loan app. Registration on the platform is straightforward, and it takes less than 5 minutes to access loans from the platform quickly.

The LCredit loan app has a rating of 4.2/5.0 with over 1M downloads and over 70,000 reviews. Like many other loan apps, the app uses your phone data to determine your creditworthiness.

Should you borrow a loan from LCredit or not? We will get to know in this article. What determines that a loan provider is reliable is the interest rate, amount loanable, repayment duration, repayment penalties, and reputation with their users.

This LCredit loan app review will help you determine if you should borrow a loan from the platform to not fall victim to loan providers humiliating you.

Update 2023

The LCredit Loan service was initially a good loan app but was recently banned and listed among some of the fake loan apps in Nigeria. The loan app company invades the privacy and steals its users’ data. The company’s app was also banned by Google for violating some of its rules and for malicious and fraudulent behavior by the app.

LCredit loan requirement

Before you can borrow loans from any loan provider that uses an app, you must first have a smartphone where you will install the app. Other requirements are your Bank verification number and, of course, an account you want your loan to be disbursed. Also, LCrecit mandated that you must be between 20-55 years old before being approved for a loan.

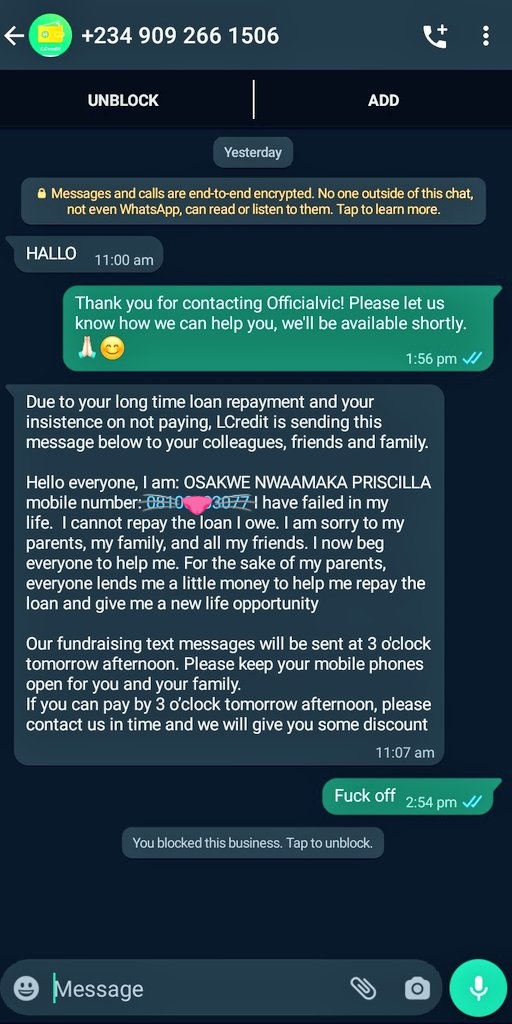

The reason Quick Loans provider uses the app is that they will be able to track not only you but also get the list of contacts on your phone. That is why you get people complaining about their friends and families being called by loan providers when they refuse to pay back their loans on time.

How to download the LCredit Loan App

Downloading the LCrdit Loan App is an easy task that takes less than 5 minutes. All you have to do is;

- Go to Google Playstore or App Store and search for LCredit. The required LCredit loan app will pop up.

- Alternatively, you can visit this link to install the app on Google Play Store or App Store.

- Install the LCredit Loan app

- Launch the app for the first time, then, follow the onscreen instructions to Register.

- You will be asked to provide information like your full name, BVN, phone number, and account number.

- An OTP will be sent to your phone number to confirm you own the phone.

- After entering the required information, you will be directed to the Homepage.

- Request for your desired loan and the loan will be issued to your bank account within minutes.

In general, your phone’s data, including SMS, apps installed, location, and phone details, is used to determine your loanworthiness. If you plan on paying your loan before the end of the duration, you don’t need to worry. But if you do not meet up with the payment on time, LCredit might use your phone information to push you to pay your loans.

We have heard of some LCredit users complaining that messages were sent to some of their phone contacts naming them as fraudsters, and some complained of giving them some kind of bad reputation. Some reputable loan platforms don’t have this harmful practice. Check out the best loan apps in Nigeria.

LCredit USSD Code

Unfortunately, LCredit does not utilize the use of USSD banking. The only platform you can use to borrow a loan is their mobile app, which you can download from the Play Store or App Store.

LCredit Loan Interest Rate

LCRedit, like many other financial institutions that give loans, receives a small sum of money in exchange for lending you money, which is known as interest. The amount of interest you will pay is determined by the interest rate and the loan duration.

The LCredit loan interest rate is between 39% to 300% annually. But for starters, the maximum amount loanable is NGN 5,000, and the interest rate is 39% for a month duration. For example, if you lend NGN 5,000, your interest is NGN1950 which means you will pay back NGN6950 at the end of a month.

LCredit Loan Amount Limit

LCredit Loan app’s minimum loan amount is NGN 5,000, and the maximum loan amount is NGN 50,000. You can borrow any amount from NGN 5,000 to NGN 50,000; if you have a good stand with LCredit, your loan limit will be increased to up to NGN 200,000.

LCredit Loan Repayment Duration

According to the LCredit website, the loan repayment period ranges from 4 – 52 weeks (i.e. a month to a year). So, the loan is repayable for a month, two months, six months, or 12 months.

However many users have found out that for new users, the loan duration is only 14 days, and after that, they are requested to pay late payment penalties, which have an increased interest rate. The interest rate is very much compared to some other loan apps available in Nigeria.

LCredit Late Repayment Penalties

When you don’t repay your loans at the agreed date, you have to pay some extra recurring fees as a penalty. This is a method used by many loan providers, and it is included in their terms and conditions. However, there are loan apps like Branch that don’t charge you penalty fees.

LCredit loan app late repayment penalties are a bit of a downside to using the app. The app charges you an extra 2% daily for as long as you don’t repay your fee. The amount you will have to pay back can get very high with time.

LCredit Loan OverPayment

If you overpaid your loans, the only way to get your payment back is through LCredit customer care. The customer care contacts can be found on this page when you stroll down.

How to Repay LCredit Loan

LCredit gives its users three different methods to repay their loans. You can repay your loans via bank transfer or debit card. Any method works, but using your card might mean LCredit has your debit card details. Some users have complained LCredit automatically debited their account immediately after their loan was due without being informed.

So, I will suggest you use to pay back your loans through bank transfer.

LCredit Loan Contacts

Website– https://www.lcredit.ng/

- Hotline– +234 812 139 4395

- Email– support-ng@cashigo.ng

- Instagram– https://www.instagram.com/LCredit.ng/

- Facebook– https://www.facebook.com/lcreditNg

- Twitter– https://twitter.com/LcreditNg

LCredit Loan App Verdict

If you are the type that makes sure to always repay your loans at the stipulated time, then LCredit is safe to use. Most people have issues with the loan provider when they refuse to pay back their loans. Also, your repayment fee will be increased when you don’t pay it back on time.

If you are not sure of repaying your loan on time, you can increase your repayment duration, which will incur an extra repayment fee, or you shouldn’t use the LCredit app at all.

If your loan is not paid back on time, you will begin to receive many messages from LCredit, and some of these messages might be a treat. Most of the goodies from loan apps are usually “We will send messages to your contacts informing them of the loans you owe.”

LCredit customer service is really bad. They keep informing you through calls before the due date of your loan and on the due date. After the due date, the remaining calls you get are a threat.

It would be best if you kept all of this in mind before you apply for an LCredit loan. You can also check our review of reputable loan apps in Nigeria, like FairMoney and Branch. You can share your thoughts about LCredit in the comment section below.