The Trade Monitoring System (TRMS) is a digital platform established by the Central Bank of Nigeria (CBN) to allow students, exporters, and anybody seeking medical attention in other countries to apply for foreign exchange (US dollars, British pounds, and Euros) via trade forms such as NXP, NCX, and form A.

Before 2021, these forms were obtained physically from banks, and your bank will process foreign exchange for you. This means that if you want to pay your Personal and Business Travel Allowance (PTA/BTA), school fees abroad, Non-Commercial Exports (NCX), and the Nigeria Exports Proceeds Form (NXP), you will obtain a physical form from the bank and the bank process FX for you.

The CBN has now revealed that the new method (The Trade monitoring system) will be automated from start to finish, with all applications being completed online.

In this article, we explained how to register on the Trade monitoring system, and how to apply for e-form A, NCX, and NXP. We will also explain all of these forms in detail.

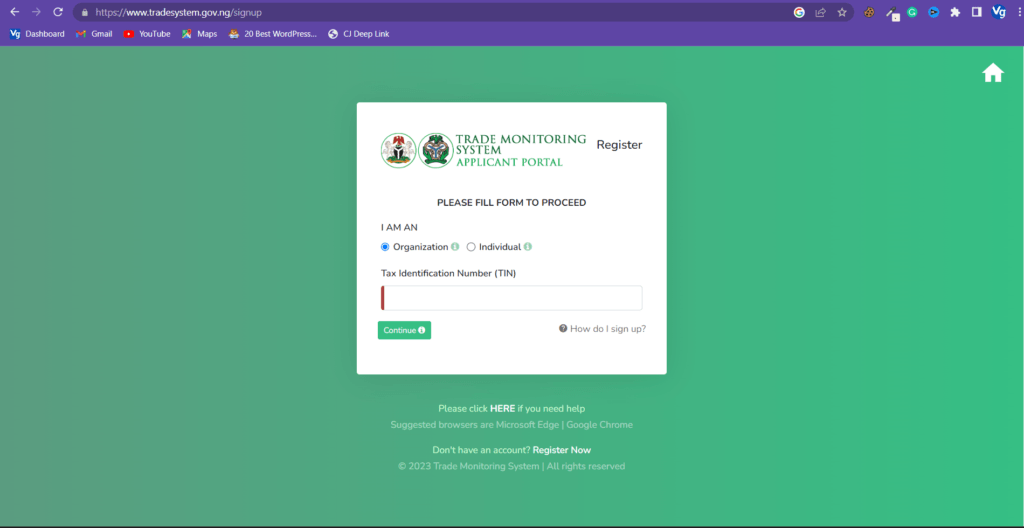

How to Register on the Trade Monitoring System

The Trade Monitoring System Portal is a simple and effective platform. Here is the new step-by-step procedure for paying your school fees abroad, applying for PTA/BTA, and applying for foreign exchange to process exports:

Registration Requirement: You must have a TIN (Tax Identification Number) as an organization. If you are enrolling as an individual, your email must be linked to your BVN.

- Go to the official portal at Tradesystem.gov.ng.

- Scroll down to Applicants and then click on Go to Portal.

- On the login Page, click on Register Now.

- Choose if you are an organization or an individual.

- For Organization you will be asked to enter TIN while individuals will enter their BVN.

- Type in your chosen Password.

- Reconfirm the password you entered.

- Click on continue.

- You will receive an OTP on the number registered with your BVN. Enter the code.

- Then, click submit.

Form A, NXP, and NXC – Difference

In the context of foreign exchange transactions in Nigeria, NXP (Nigeria Export Proceeds) and NCX (Nigeria Customs eXchange) are related to the documentation and regulatory processes. At the same time, Form A is a document used for processing foreign exchange transactions. Here’s an overview of each:

NXP (Nigeria Export Proceeds)

NXP is a documentation requirement for exporters in Nigeria. It is a form that exporters need to complete and submit to authorized banks to declare their export proceeds. The purpose of NXP is to ensure that export earnings are repatriated into Nigeria and to facilitate accurate data collection for economic planning and monitoring.

When exporting goods or services from Nigeria, exporters are required to open an NXP form through the TRMS portal. The form captures essential details about the export, including the exporter’s information, goods or services being exported, destination, invoice value, and other relevant information. After the completion of the export transaction, the exporter is expected to repatriate the export proceeds into a Nigerian bank account within a specified timeframe.

NCX (Nigeria Customs eXchange):

NCX refers to the Nigeria Customs exchange platform, which is an electronic system used by the Nigeria Customs Service for the processing and documentation of import and export transactions. It facilitates the exchange of information between importers, exporters, shipping companies, and customs authorities.

The NCX platform streamlines customs clearance by allowing importers and exporters to submit relevant documentation electronically. This includes submitting shipping documents, invoices, certificates of origin, and other required customs declarations. NCX aims to improve transparency, reduce processing time, and enhance efficiency in customs operations.

Form A:

Form A, as mentioned earlier, is a document used for processing foreign exchange transactions in Nigeria. It is issued by the Central Bank of Nigeria (CBN) and is required for various purposes, including importation, payments for services, payment of school fees abroad, and other eligible transactions. Form A captures details of the transaction, such as the amount involved, purpose, and parties involved.

Form A is part of the regulatory framework established by the CBN to monitor and regulate foreign exchange transactions in Nigeria. By completing and submitting Form A, individuals and businesses comply with the necessary documentation and reporting requirements for foreign exchange transactions.

It’s important to note that the specific requirements and procedures for NXP, NCX, and Form A may vary, and it’s crucial to consult the Central Bank of Nigeria and relevant authorities for the most up-to-date information and guidelines on foreign exchange transactions in Nigeria.

TRMS Application Process Flow/Stages

First Stage- ADB_REVIEWER

This is the initial step. The reviewer thoroughly checks your details for accuracy, verifies your account number, and confirms your attached documents. When the application is approved, it is forwarded to the reviewer’s supervisor.

Second Stage- ADB_SUPERVISOR

The supervisor also double-checks the completed information and confirms the submitted papers. Following approval, a 16-digit AA number is created, and the application is forwarded to the disbursement team for approval of the cash/transfer payout.

Final Stage- ADB_DISBURSEMENT_REVIEWER

The disbursement reviewer looks over the application again and approves the cash or transfer disbursement. A mail notification will be sent to the applicant as well.

How to Register

How to Apply For Personal Travel Allowance/Business Travel Allowance (PTA/BTA)

To apply for personal Travel Allowance/Business Travel Allowance (PTA/BTA), follow these procedures;

- Go to the TRMS portal login page

- At the top, click on Form A, then Start Application.

- The first stage requires you to enter all your Travel Details and information.

- Next, you will Choose PTA/BTA

- Upload all necessary travel documents (return flight ticket, visa page, and international passport data page)

- Upload your company’s letter of nomination and certificate of incorporation (in case of BTA only)

- Enter your bank account number

- Select your bank from the dropdown

- Select the bank branch that you prefer to treat the transaction

- Click on Submit

After successful registration, you will have to follow up with your bank to know when it is approved, using your Af-number. PTA/BTA takes typically 1-3 working days to process.

How to Apply For School Fees and Upkeep

Here is how to apply and pay your school fees:

- Login to the TRMS Portal.

- Click on Form A and then Start Application.

- Choose Educational Fees

- Select School fees

- Enter all your school details

- Upload necessary documents (international passport data page, provisional admission letter, school invoice, WAEC/first-degree certificate)

- Upload the sponsor’s identification (if the student is paying through a sponsor)

- Input the school fees amount (max $15,000 per semester)

- Input the bank account number to debit

- Choose the preferred bank from the dropdown

- Click on Submit

After successful registration, you will have to follow up with your bank to know when it is approved, using your Af-number. School fees normally take 1-3 working days to process.

For Upkeep

- Visit the TRMS Portal.

- Click on Form A and then Start Application.

- Choose Educational Fees

- Select Upkeep

- Enter all your school details

- Upload necessary documents (international passport data page, provisional admission letter, school invoice, WAEC/first-degree certificate)

- Upload the sponsor’s identification (if the student is paying through a sponsor)

- Input the school fees amount (max $3,000 per semester)

- Input the bank account number to debit

- Choose the preferred bank from the dropdown

- Click on Submit

For Medicals Bills Payment

- Login

- Click Form A then Start Application

- Select Medical Allowance

- Enter all necessary details

- Upload necessary documents (return flight ticket, visa, int’l passport data page, specialist’s letter of recommendation for treatment in the destination hospital)

- Attach the sponsor’s authority to debit (if the patient is paying through a sponsor)

- Enter bank account number to debit

- Choose the preferred bank from the dropdown

- Click on Submit

How to Successfully Cancel Form A Application & Re-Apply

Before you start filling your Form A on the TRMS portal, It is highly recommended that you use the utmost caution. This is due to the fact that after you confirm and submit your application, you will not be able to make any changes.

You cannot change most of the details you enter during the application process. The only way to make changes is to upload more documents to prove your claims which may take time to get approved.

However, if you already make the mistake, the bank you chose may simply refuse to treat your application for whatever reason, here is how to cancel your application and reapply.

- Login to the TRMS Portal

- Click on Form A then History.

- At the extreme right of the application, you will see a dropdown icon.

- Tap the dropdown

- Next, Click Cancel

- Input the reason for cancelation

- Upload the supporting document (if any)

- Upload a blank document (if none)

- Click Submit

But it doesn’t stop there.

If you cancel and reapply immediately, you will notice that the amount of the canceled application has been deducted from your $4000 maximum (in the case of PTA). Don’t worry, here’s what you need to do:

Case 1:

The cancellation request is subject to approval by the processing bank only if the application is canceled prior to initial bank approval (before receiving a form ‘AA’ number).

This means that if the canceled application was in the ‘ADB Reviewer stage when it was canceled, the selected bank must authorize the cancellation.

Case 2:

When a cancellation request is made after the first ADB approval (after a form number has been granted), it is subject to approval by the CBN TED.

This means that if you cancel after receiving a form ‘AA’ number, CBN must approve your cancellation.

Case 3:

The applicant must provide a letter requesting cancellation as well as any supporting documentation. This document is not required by all banks; you can simply tell them the reason for the cancellation and they will proceed.

Conclusion

The new Trade Monitoring system is very effective and better than the former way of obtaining Form A as we can now do it anywhere at any time. Registration on the platform is super easy and can be completed in under 5 minutes. You should however take precautions while filling out the form because you cannot change any details once the form has been submitted. Approval of your application takes between 1-3 business days. If you have any inquiries, feel free to comment below.