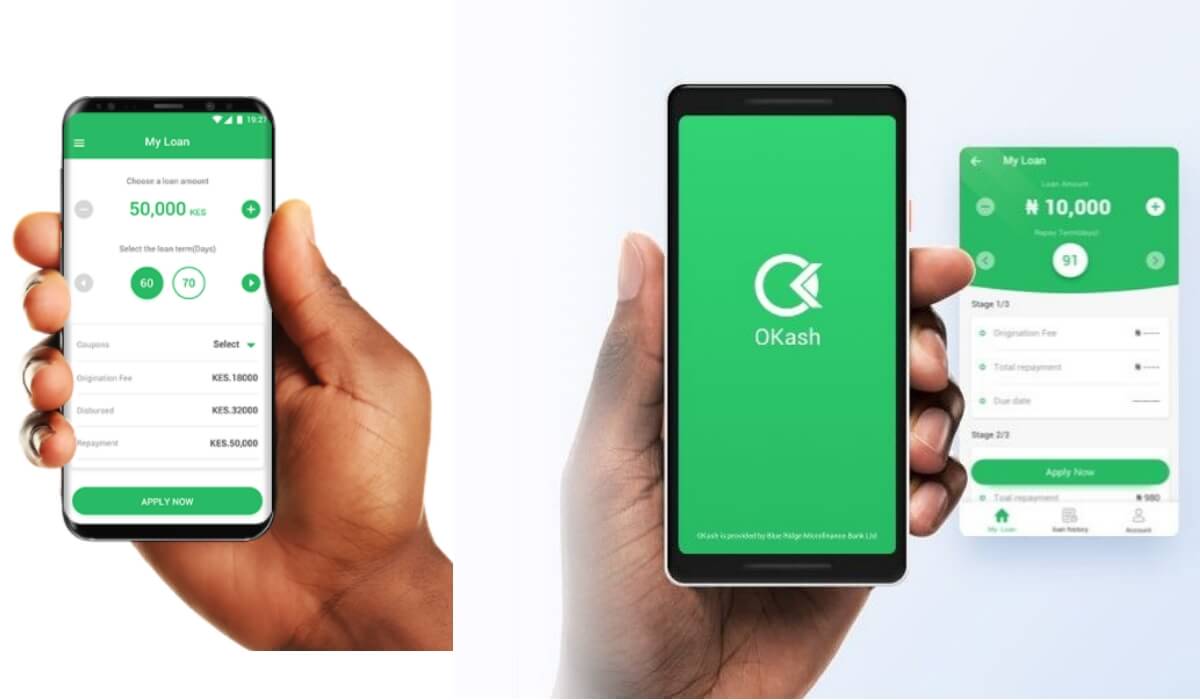

The Okash Loan app is one of the best mobile loan apps available to Nigerians and Kenyans. With the Okash loan app, you can request loans anytime and the amount will be disbursed to your account within minutes if approved.

If you need urgent personal loans, then the Okash loan app is a viable option to choose. The app does not require paperwork and numerous documents required by banks.

Our Okash Loan app review explains everything you need to know about Okash loans, how to apply, interest rates, requirements, repayment options, benefits available, and so on.

The Okash Loan was just shut down by the Nigerian government, which means Nigerians can no longer borrow money from this platform. But for Kenyans, you can still access the Okash loan app in your country. The federal government of Nigeria bans these loan apps because of customer privacy violations.

What is the Okash Loan App?

Okash Loan App is a product of Opera Pay (Opay), first established in Kenya in 2018 and then spread to Nigeria and other parts of Africa. OKash is one of the supplementary services offered by Opera Pay as part of its O universe. Other services include OFood, OBUS, ORide, and so on.

The Okash Loan app is quite popular among many Rural farmers in Kenya as many of them use the app to get urgent loans for their businesses.

Okash Loan Requirement

Requirement For Nigerians

To qualify for Okash loans, all you need is an Android smartphone to download the app, your Bank Verification Number, your BVN, and your account number, and must be between 22-55 years old. These requirements are necessary to identify you and also comply with government laws.

Requirement For Kenyans

Before you can get loans from Okash, you will need to provide the following details;

- A Smartphone- where you will download the app

- A national ID card – To be sure you are more than 18 years old

- You must also be a registered Safaricom subscriber.

How to download the Okash Loan App

Downloading this great loan app is not a difficult task at all. All you have to do is;

- Visit the Google Play store and search for Okash. The required Okash loan app for your country will pop up.

- Alternatively, you can visit this link to install the app on Okash For Nigeria, and Okash for Kenya.

- Install the Loan app.

How to Apply for Okash Loans

To apply for Okash Loans, check that you have all the necessary requirements to apply for loans. Generally, your phone’s data, including your SMS, apps installed, location, and details on your phone, are used to calculate your loanworthiness. Don’t be afraid if someone might steal your data; Branch uses end-to-end encryption, and they do not share your information.

How to Apply for Okash Loans in Nigeria

Applying for Okash loans is very easy in Nigeria, all you have to do is;

- Install the required Okash loan for Nigerians

- Enter your phone number and create a password

- A verification code will be sent to you via SMS, enter the confirmation code on the next screen

- Enter your name, address, and other details including your BVN number.

How to Apply for Okash Loans in Kenya

Follow these steps to apply for Okash loans;

- First, install the Loan app

- Launch the app for the first time, then, follow the onscreen instructions to Register.

- Enter your Safaricom phone number and set a password.

- You will receive a text message for SMS verification. Enter the SMS verification code you just received.

- Upload your National identity card

- Enter your M-Pesa account details, where you will receive payment

- Apply for your loan of interest

- The final application result will be displayed on the app, and you will be notified through SMS whether your application has been approved.

- After the loan has been approved, you must e-sign the loan agreement.

- Then, the loan will be disbursed into your M-PESA account

Okash USSD Code

You can also access Okash loans via USSD if you are in Nigeria. The Okash loan USSD code is *955#, and you can dial this number from any mobile network in Nigeria.

Okash Loan Interest Rate

Like many financial organizations offering loans, Okash receives a small amount of money from lending you money called interest. The interest you will pay is dependent on the interest rate and the duration of the loan.

The Okash loan interest rate is between 9.1% to 41%. The interest rate is very high when compared to some other loan providers like Branch.

For example, a 91-day loan payment term has a 41 percent processing fee and a 9.1 percent interest rate. The processing charge for a loan with a principal of NGN 3,000 would be NGN 1,229, the interest would be NGN 273, and the total amount due would be NGN 4,502.

The interest here is a bit much but when you request loans for a shorter period, the interest rate is lower. For example, for a 30-day loan payment term of NGN 3000, the processing fee will be NGN 419 and the interest of NGN 93, and the total amount due will be NGN 3,512.

The same analogy applies to loans borrowed in Kenya.

Okash Loan Amount Limit

Okash Loan app minimum loan amount is NGN 3,000, and the maximum loan amount is NGN 500,000 in Nigeria. In Kenya, the minimum loan amount is KSh 2,500 and KSh 50,000.

Okash Loan Repayment Duration

Okash offers loan terms ranging from 4 – 12 weeks. So, the loan is repayable for 30 days, 60 days, or 91 days.

Okash Late Repayment Penalties

If you refuse to repay your loans after the agreed date, you will be charged a late fee of 2% per day automatically after the agreed date of payment.

Okash Loan Overpayment

If you mistakenly overpay your loans, your extra payment will be returned back to your account within 24 hours. If not you have to contact the Okash support team.

Repay Okash Loan Using Okash Paybill Number

For Kenyans, you can repay your Okash loan using Okash Paybill. Follow the instructions below to repay your loan using Okash Paybill;

- Navigate to M-Pesa in your Safaricom menu on your phone

- Select Lipa na M-PESA

- Choose the Paybill option

- Enter the Paybill number 612224

- For the account number, enter the M-Pesa number with which you registered.

- Enter your repayment amount

- Enter your M-PESA pin

- Confirm that all details are correct and press ‘OK’.

How to repay your Okash Loan for Nigerians

To repay your loans, you are given three options. You can pay via bank transfer, Debit card, or Cash. The process is straightforward,

- Open the Okash loan app and go to the homepage.

- If you have any loan that has not been paid back available, it will appear on the homepage. Tap on it to make your payment

- Choose your desired method of payment

Your loan payment status will show up after payment, either successful or any other type of message.

Okash Loan Repayment Date Extension

Some Loan platform like the Zenka loan app, gives you the possibility to extend your loan due date. Okash has no loan repayment date extension. In other words, you cannot extend the agreed date of payment. Instead, you will be charged daily if the loan is not repaid after the date.

Okash Loan Contacts

For Kenyans

- Phone number – +254 20 7659988

- Instagram– https://www.instagram.com/okash_kenya/

- Twitter – https://facebook.com/OKash-APP-106143808027876/

For Nigerians

- Email– [email protected]