FairMoney was founded in 2017 by Laurin Hainy, Matthieu Gendreau, and Nicolas Berthozat as an online lender that offers customers in Nigeria quick loans and bill payments. The company recently launched in India as well and has continued to provide more loans to its users.

In 2020, the company disbursed $93 million in loans to more than 1.3 million consumers who submitted over 6.5 million loan applications according to the CEO when speaking with Techcrunch.

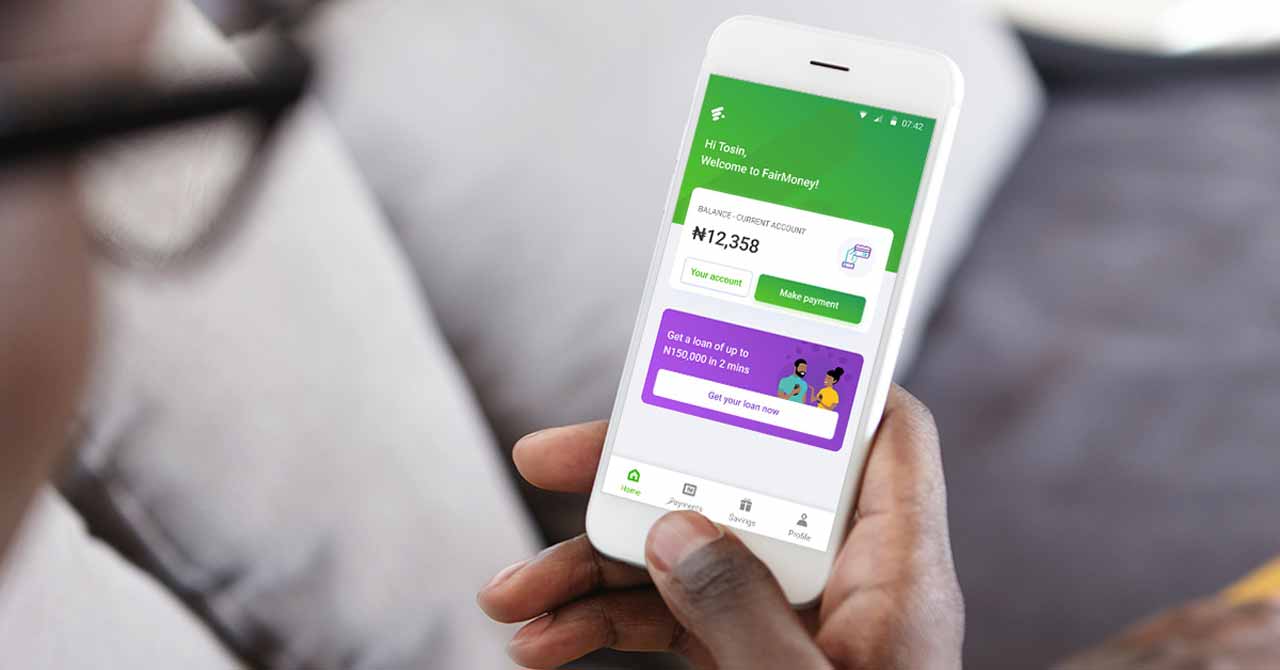

FairMoney offers loans to its users through its mobile loan app which is available on the Google Play store. At the time of writing, the FairMoney loan app has a rating of 4.5/5.0 on the Google Play store, over 5M downloads, and over 300K positive reviews.

The rest of this article gives you everything you need to know about the FairMoney loan app, including interest rate, loan amount limit, requirements, how to apply for loans, USSD code, amount limit, repayment duration, and so on.

Without further ado, let’s dive in.

FairMoney Loan Requirement

All you need is an Android smartphone, your Bank Verification Number (BVN), your phone number, and your account number to qualify for a loan.

In general, your phone’s data, such as SMS, installed apps, location, and other information, is utilized to determine your loanworthiness. Don’t worry about your data being stolen; FairMoney uses end-to-end encryption and does not share your information.

How to Apply For FairMoney Loan

Downloading the FairMoney Loan App is not a difficult task at all. All you have to do is;

- Head over to the Google Play store and search for FairMoney. The required FairMoney loan app for your country will pop up.

- Alternatively, you can visit this link to install the app on the Google Play Store.

- Install the app

- Launch the app for the first time, then, follow the onscreen instructions to Register. I would appreciate it if you used my referral code (XPPWV).

- You will be asked to provide your phone number, then your Full name and BVN number. You will also be asked to allow the app access information on your phone.

- Provide your account number, and where you want the money to be disbursed.

- Provide the necessary details and you will be taken to the Homepage.

- Request for your desired loan and the loan will be issued to your bank account within minutes.

FairMoney USSD Code

If you are using an iPhone or you don’t have an Android phone, thankfully, the FairMoney USSD code is not the only platform you can use to request loans. You can also request for FairMoney loans using the FairMoney available USSD code.

The FairMoney USSD code is *322*6#. Dialing this code will take you to a registration platform and you can also request for a loan after your registration has been approved using the same code.

FairMoney Loan Interest Rate

FairMoney, like many other financial institutions that provide loans, receives a modest fee for lending you money called interest. The amount of interest you pay is determined by the interest rate and the length of the loan.

FairMoney loan interest rate is between 2.5% to 30% (APRs from 30% to 260%). For Example, when you borrow NGN100,000 for a duration of 3 months, the interest rate will be 16% (NGN33,577.36). If you are to pay an installment, you will pay NGN44,525.79 monthly for the three months. The total amount paid back will be NGN 133,577.36 representing a 120%APR.

FairMoney Loan Amount Limit

FairMoney Loan app’s minimum loan amount is NGN 1,500, and the maximum loan amount is NGN 5,000,000 in Nigeria.

FairMoney Loan Repayment Duration

FairMoney offers loan terms ranging from 1 month to 18 months. So, the loan is repayable for a month, two months, six months, and up to 18 months.

Note: The longer the duration you choose, the higher the amount to be paid back.

FairMoney Late Repayment Penalties

If you refuse to return your loans after the specified time period, FairMoney, like many other mobile lending companies, charges an additional fee. The late repayment fees charged by FairMoney are not disclosed in the app’s or website’s information. We will update this post whenever we have the repayment fees.

I don’t recommend going beyond your loan’s repayment duration before paying it off. If you do not pay your debt on time, your creditworthiness will suffer, and the amount you can borrow will be limited.

FairMoney Loan OverPayment

If you overpaid your FairMoney loans by accident, the excess will be refunded to your FairMoney bank account within 5 working days. If the money isn’t returned, get in touch with their customer service.

How to repay your FairMoney Loan

To repay your loans, you are given three options. You can pay via bank transfer, Debit card, or USSD Code. The process is straightforward,

- Open your FairMoney loan app and go to the homepage.

- Click on Loan Details, and here you will see your repayment date and your loan history.

- Click on pay, you can put in the full amount or the amount you’d like to pay first, in case you want to pay an installment.

- Choose your desired method of payment.

Your loan payment status will show up after payment, either successful or any other type of message.

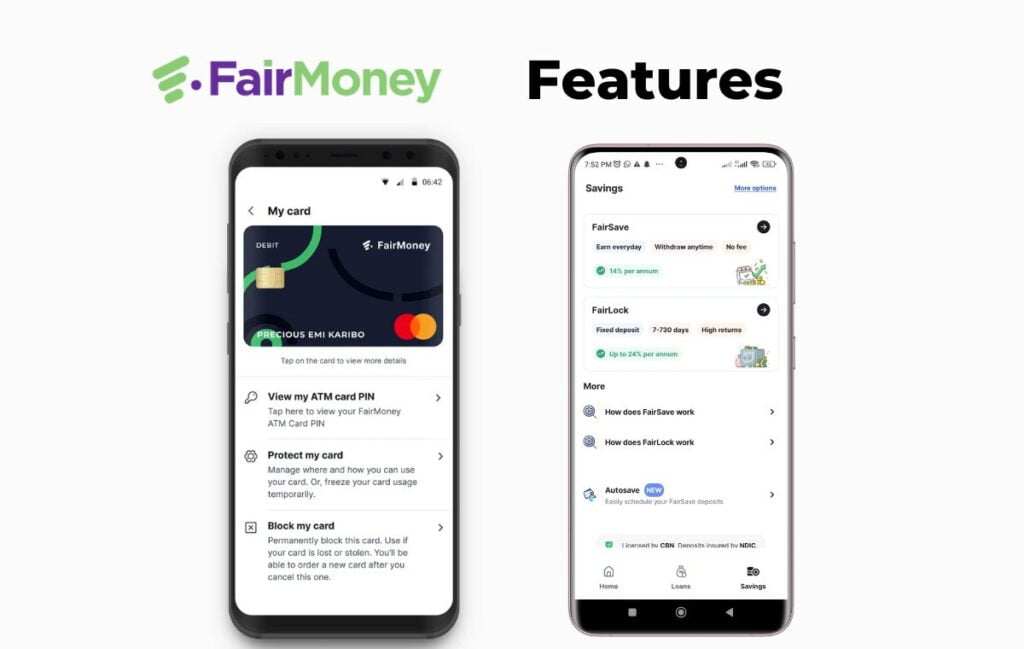

FairMoney Features

Aside from requesting loans, there are other things you can do on the FairMoney app. You can use the FairMoney App as a regular bank app. The app features some other cool stuff like FairSave, Fair Lock, and FairMoney Debit Card.

FairSave

FairSave allows you to save money on the Fair Money app. Like every other banking system, you get interest while you save. You can withdraw your money anytime you like and every transaction is free. You don’t have to pay any transaction fees. So with the FairSave, you get to make money every day by just saving. The interest is 14% per annum.

FairLock

With FairLock, you get to make even more money. All you have to do is save and lock in some funds and specify the duration with which you want the money locked. What this means is that you send some money you won’t be spending for at least 30 days to the FairLock and you get to enjoy 24% interest per annum. For example, when you lock ₦1,000,000 naira for a year, at the end of the year, you will be getting an interest of ₦240,000. So, when you withdraw your money after a year, you will be withdrawing ₦1,240,000.

You should, however, note that you will not get interest if you withdraw your money before the end of the duration.

FairMoney Debit Card

You can also request a FairMoney Debit Card right from the app and it will be delivered to your location. The card is free but you will have to pay a delivery fee of ₦1,000.

FairMoney Verdict

I’ve personally used the FairMoney app and I can say that this is a reputable company. The FairMoney Loan interest rate is very good compared to other lenders, and they serve their purpose well, but at the same time, the app has some defects.

PROs

One of the features I like about the app is the fact that you can extend your loan when you discover you won’t be able to pay back at the stated date. And the extension fee as of the time of writing is only ₦4,400 regardless of the amount you are supposed to repay. You can extend your loan as many times as possible. You should note that you can only extend your loan before 7 days to payment, if the payment period is less than 7 days, you won’t be able to extend anymore. When this happens, the only way to extend your loan is to pay part and then extend the rest.

Another cool thing about the app is that you can top-up your loan. So, if you want more loans, you can instantly and easily top up your loan. Other benefits from the app include the opportunity to save and make money when you refer your friends and they take their first loan.

Cons

My biggest problem with the platform which can be very annoying to most people is the calls you get from FairMoney. You get called multiple times when you do not use the app for sometimes. For me, it is very annoying and I keep telling them to exclude me from the list of those they contact but to no avail. You keep getting a lots of calls now and then informing you of one or two things about the app and asking when you will take your next loan. I get that this is for marketing purpose, but at the same time is just very annoying.

When your loan is due and you haven’t paid back that same day, you get the most annoying call. The manner of speech and the tone of voice is allows provocative, you will be spoken calmly to come and take a loan you don’t need, but once it’s due, you get spoken to in harsh words.

FairMoney Customer Care

Website– https://fairmoney.io/

- Facebook– https://web.facebook.com/fairmoney.ng/

- Twitter – https://twitter.com/fairmoney_ng

Will you be taken the FairMoney Loan? Have you used FairMoney before? Share your experience in the comment section below.