If you have previously received a HELB (Higher Education Loans Board) loan or bursary and are now seeking additional financial support for your education, you may be eligible to apply for a second or subsequent HELB loan or bursary. Understanding the application process and requirements for these subsequent loans is essential to ensure a smooth application experience. All of the process can be done online without leaving your home. This post will guide you through the steps involved in applying for a second or subsequent HELB loan or bursary, enabling you to access the financial assistance you need.

Read Also: How to Check CRB Status Online | Loan apps without CRB check

Types of HELB Application

When it comes to applying for HELB loans, there are two types of applications;

- First-Time HELB Application: The first-time HELB application is for students who have never applied for or received benefits from HELB before and are doing so for the first time. Whether you apply in your first, second, third, or following years, the original application you submit is referred to as a first-time HELB application.

- Second and Subsequent Loan Application: Students who have previously received a HELB loan or bursary and are seeking additional financial support for subsequent academic years can apply for a second or subsequent loan. These applications allow students to continue accessing financial assistance from HELB throughout their educational journey. This article is all about how to apply for second and subsequent loan applications.

Eligibility, Requirement, and Qualification for HELB Second and Subsequent Loan

To apply for a second or subsequent loan from HELB (Higher Education Loans Board) in Kenya, applicants must meet certain requirements, eligibility criteria, and qualifications. Here are the key factors to consider:

- Applicants must be Kenyan citizens. Non-Kenyan citizens are generally not eligible for HELB loans unless they hold a valid Kenyan permanent residency status.

- Applicants must have previously applied for HELB before.

- Applicants must have successfully completed the repayment of their previous HELB loan or bursary. This includes fulfilling all repayment obligations and clearing any outstanding balances.

- Applicants must be enrolled or admitted to an accredited institution of higher learning for the subsequent academic year. This can include pursuing undergraduate, postgraduate, or technical and vocational education and training (TVET) programs.

- Applicants must demonstrate good academic standing by maintaining satisfactory academic progress throughout their previous studies. This may include meeting the minimum grade point average (GPA) or performance requirements set by the institution.

How to Apply For HELB Second and Subsequent HELB Loan And Bursary

1. Check your Eligibility

Before proceeding with the application, verify your eligibility for a second or subsequent HELB loan or bursary. Typically, you must have successfully completed the previous loan or bursary repayment, demonstrate continued financial need, and maintain good academic standing. Familiarize yourself with the specific eligibility criteria set by HELB for second and subsequent loan applications to ensure that you meet all the requirements.

2. Gather the Required Documents

Gather the necessary documents to support your application. These may include your national identification card, admission or enrollment letter from the institution, academic transcripts or progress reports, proof of previous HELB loan or bursary repayment, and any other relevant supporting documents as specified by HELB. Ensure that all the documents are up to date and accurate to facilitate the application process.

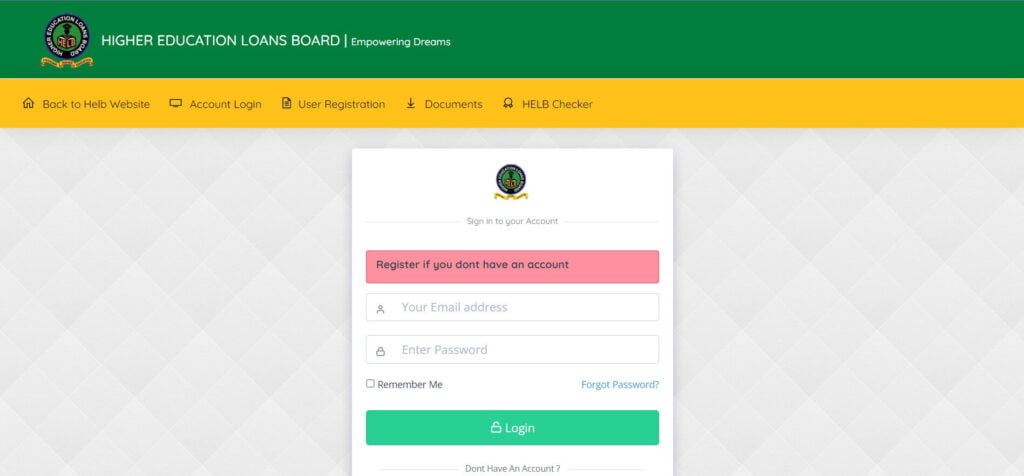

3. Access the HELB Online Portal

Visit the official HELB website and log in to the HELB Student Portal using your existing account details. If you do not have an account, create one by providing the required information. The HELB Student Portal serves as the online platform for loan and bursary applications, allowing you to submit your subsequent application conveniently. You can also apply by using the USSD Code *642# or HELB mobile app. You just need to follow the onscreen direction and everything will be set.

4. Complete the Loan/Bursary Application Form

Locate the application form for second or subsequent loans or bursaries within the HELB Student Portal. Fill out the form with accurate information, paying close attention to details such as personal information, institution details, loan amount requested (if applicable), and any additional information required. Take your time to ensure that all the fields are completed correctly and comprehensively.

5. Submit the Application and Await Verification

After completing the application form, submit it through the HELB Student Portal. The application will go through a verification process to confirm the accuracy of the provided information. HELB may reach out to you or your institution for further verification or clarification if needed. Be patient during this stage and promptly respond to any requests for additional information to expedite the verification process.

6. Monitor Application Status

Use the tracking features available on the HELB Student Portal to monitor the progress of your subsequent loan or bursary application. Regularly check for updates on your application status and stay informed about any communication from HELB. This will help you stay up to date with the progress of your application and enable you to address any issues or provide additional information if required.

7. Loan or Bursary Disbursement

If your application is approved, HELB will disburse the second or subsequent loan or bursary amount directly to your institution. The disbursement process is typically carried out at the beginning of each semester or academic year. Ensure that you communicate with your institution’s financial office to understand the disbursement procedures and any additional requirements, such as signing loan agreements or completing necessary documentation.

How to Apply Via the Online Portal

To apply for a second or subsequent HELB loan via the HELB website, follow these steps:

- Access the HELB student portal, and log in.

- Navigate to the Loans Section of your dashboard.

- Choose your study level (Master’s, Ph.D., Degree, Diploma, Certificate, etc.).

- Select your Loan type, i.e., For Degree students choose the “Undergraduate subsequent loan application“. For Diploma and Certificate students choose the “TVET subsequent application” and for KMTC students choose the “Afya Elimu subsequent application”, etc.

- Select the second and subsequent loan applications and click on apply.

- Accept the terms of financial literacy and proceed.

- Check that your information is correct.

- Then click the submit button.

- Your loan application serial number will be provided to you as proof that your application was successfully received by HELB.

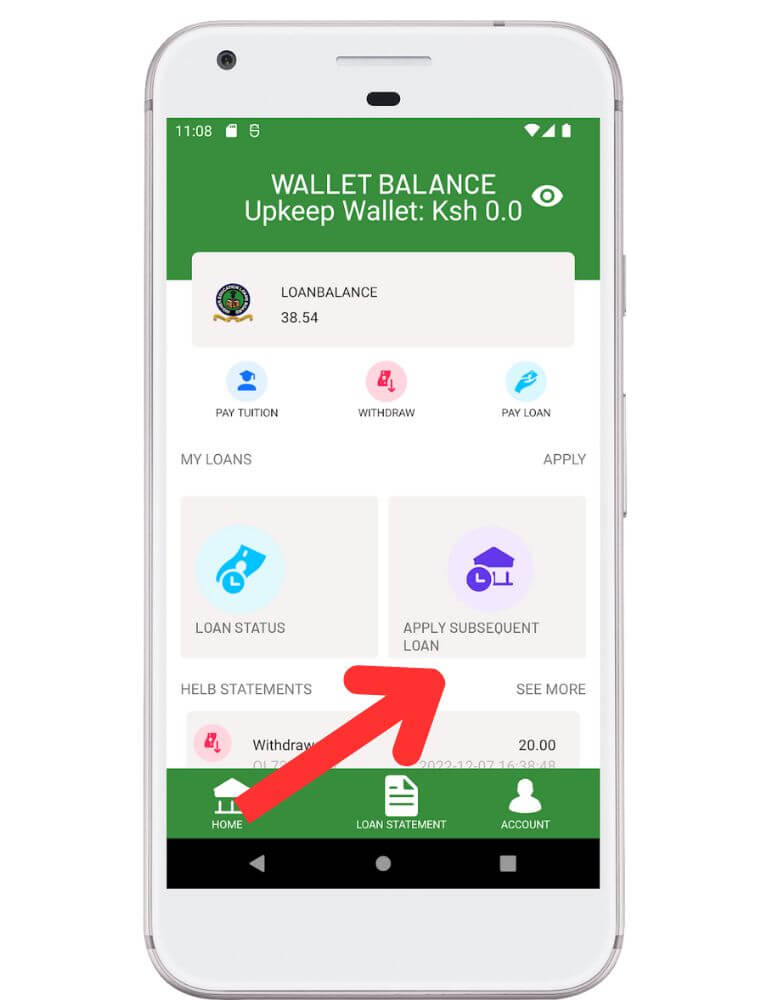

How to Apply Via The HELB Mobile App

To apply for a second or subsequent HELB loan via the mobile app, follow these steps:

- First, Go to the Google Play store and search for the HELB app.

- Install and Launch the HELB mobile application.

- Log in to your account.

- Navigate to the Loans section.

- Select the type of loan you wish to apply for, i.e. Second and subsequent Loan.

- Select “Undergraduate subsequent loan application” for degree students. Choose “TVET subsequent application” for Diploma and Certificate students, “Afya Elimu subsequent application” for KMTC students, and so on.

- Apply for the loan by clicking the apply button next to it.

- Accept the financial literacy form and the service terms.

- Check that your information is correct.

- Then click the submit button.

- This will send your HELB following application to the loans board automatically.

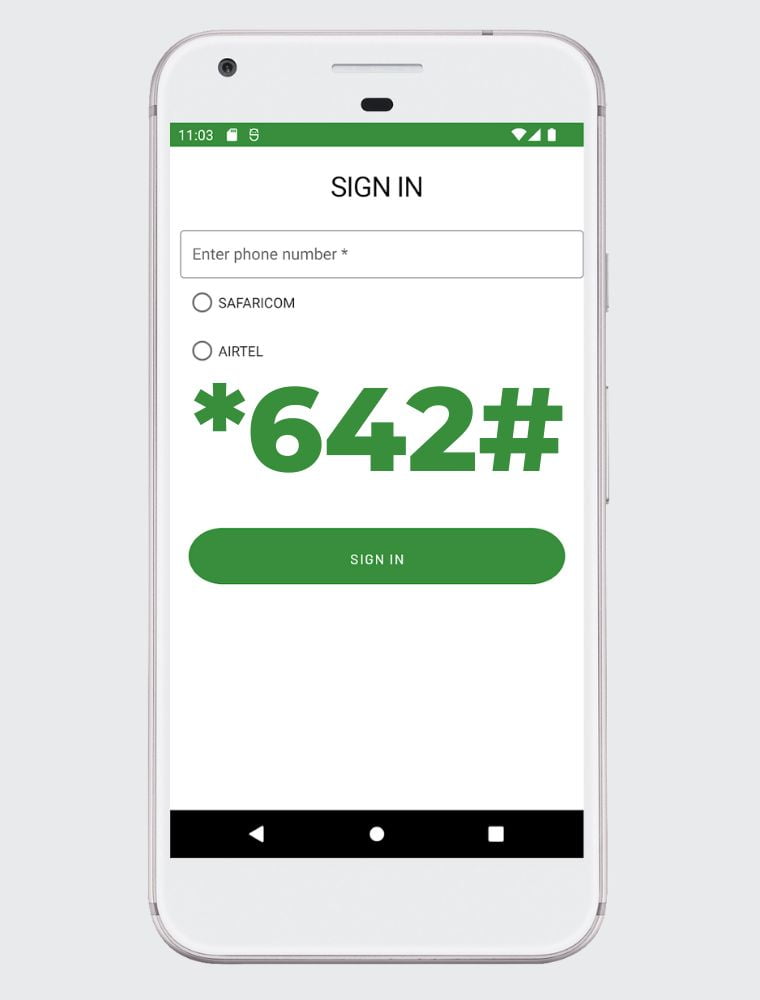

How to Apply Via USSD Code *642#

For those who don’t have access to a smartphone or computer, you can also apply for the HELP student loan application by dialing *642#. All you need is to dial this code via the sim you used to register for your first loan. The procedures are as follows:

- On your mobile phone, enter *642#.

- To log in (or register here), choose option 1.

- To log in, enter your PIN.

- Then, choose Loan Application.

- Select your level of study. Whether it’s a degree, certificate, diploma, or something else.

- Select the application type and year.

- In this instance, you will select the following loan application for this year.

- Then click the submit button.

Conclusion:

Applying for a second or subsequent HELB loan or bursary involves following a similar process to the initial application. By checking your eligibility, gathering the required documents, utilizing the HELB Student Portal effectively, and monitoring your application status, you can navigate the process successfully. Remember to meet all the specified deadlines, provide accurate information,