If you want to make some payments using your M-Pesa account but the account balance is not sufficient, Fuliza allows you to complete those transactions by giving you the extra money needed. Some might say that Fuliza is like a loan platform for M-PESA users, but it is actually an overdraft. What Fuliza does is that it allows individuals or businesses to withdraw more money from their M-Pesa account than their account holds, up to a designed limit, and it is typically subject to 20% exercise duty charges and 1% access fees.

Fuliza is available to all M-PESA customers; however, the amount of money you can spend is determined by your creditworthiness and how long you’ve been using your M-PESA account. Once you deposit or receive funds into your M-PESA account, the amount you borrowed from the Fuliza system will be automatically removed from your account.

When you opt-in for the Fuliza overdraft service for the first time, you will be assigned a limit that defines the maximum amount of overdraft you can access. Most new users are assigned a zero limit and that is because they haven’t used the M-Pesa service enough for M-Pesa to determine their creditworthiness. However, your limit will begin to increase gradually when you start using the M-Pesa service more often.

So, is it possible to increase your Fuliza limit without having to be a very heavy user of the M-Pesa service? The answer is no, but there seems to be some pitfall in the Fuliza system and most people are using the error to increase their Fuliza limit.

There are a lot of people on the internet who claim that they were able to increase their Fuliza limit using a very simple method which will be discussed below.

Read Also: How to Increase Mshwari Loan Limit

How to Hack Fuliza Limit

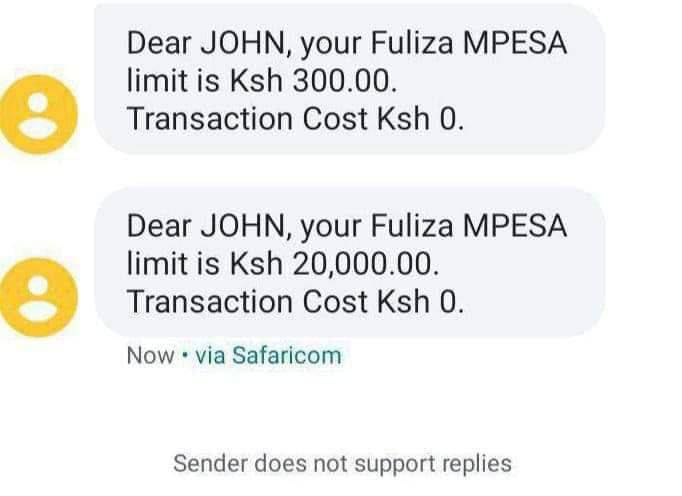

If you are the type that frequents most of all these Facebook loan groups, you would have seen a lot of people claiming that they can help you increase your Fuliza limits, and some will provide you with malicious codes that might be used to extort money from your account. Most of all these claims of increasing your loan limit are often scams, and most of them only want to extort people, even though they provide proofs to testify their claims.

With all this being said, it seems there is no way of actually increasing your loan limit manually. But there seems to be one hack that actually works, but it’s a one-in-two chance. With this hack, you may have your limit set back to zero and if you are lucky, your limits might be increased.

The good thing is that the hack is harmless and it does not require a third party or the involvement of anybody who might want to scam you.

Enough of my rambling; what is the hack to increasing your Fuliza limit instantly? The simple trick is for you to opt-out of the Fuliza service and then Opt-in again.

Like I said earlier, it’s a one-in-two. This hack might work for you and it might not. Those who will likely try this trick out will be those who have their limit at zero, because why not, there is nothing to lose. But for those of you who have your limit at some significant amount already, if the trick does not work for you, you might have your limit reset to zero.

The decision is up to you, will you be trying this trick? Have you tried the trick already? What was your experience? Did it work for you or not, let me know in the comment section and others will be able to know if they should try their luck or not.