The requirement to open a domiciliary account in Nigeria is similar to opening a Nigerian Current Account. You will be asked to come with your KYC documents, which are your National Identity card, BVN number, and your utility bill. Alongside your KYC documents, you will need to deposit an initial sum of $100 and provide two referees with a Current or domiciliary account in Nigeria.

The problem many in Nigeria face when they want to create their domiciliary account is that they don’t have friends and families with a current or domiciliary account to stand as their referees or guarantors. Also, banks don’t accept naira as a deposit for a DOM account, and you can’t exchange your naira for other currencies at the bank, which means the only option is to exchange naira for dollars, pounds, euros, etc at the Bureau de Change aka Aboki.

Thankfully, you can create a Domiciliary account in Nigeria without going through the hassle of funding your account, getting two guarantors or even stepping a foot out of your house. With the AlatByWema app, you can easily create a Domiciliary account without visiting the bank

In this article, I will show you how to open a Wema DOM account without visiting the bank, providing any guarantor, or depositing any money. With this DOM account, you can receive as much money as you want and you don’t need to deposit any dollars in the bank.

The Wema DOM account you will be opening is the Wema DOM Lite Account. This account comes with a lot of features and you don’t need to go to the bank to create the account.

What is a Domiciliary Account?

A domiciliary account, also called a DOM account, is a type of account that allows users in any country to own an account in foreign currencies. With a domiciliary account, you will be able to deposit and withdraw funds and receive, send, and transfer foreign payments using your local bank. Many in Nigeria primarily create a domiciliary account so that they can receive funds from their relatives or clients abroad. I use my domiciliary account to get payment from Google AdSense which is the platform that allows creators like myself to get paid for ads displayed on our website.

For the type of Domiciliary account, we will be creating in this guide, the account only allows to receive payment from outside the country, and withdrawal can only be done in the bank. If you want to be able to deposit, transfer, or make any other kind of transactions with your account, you will need to upgrade the account by providing two referees.

Requirements to Open an AlatByWema Domiciliary Lite Account

Like every other banking platform, you will have to provide information about yourself, to create a DOM account. The requirements to open a Wema DOM Lite Account are as;

Watch Video – How to Open a Wema DOM Lite Account

The benefit of Wema DOM Lite Account

- A convenient channel for receiving international remittances regularly.

- A safe and simple way to store and save money in foreign currency.

- There are no limits on the amount of money that can be transferred inward.

Features of the Wema DOM Lite Account (Alat By Wema)

The Wema DOM Lite Account comes with exciting features that other banks will not give you. The Alat By Wema app is a leading digital banking platform with a lot of features including the ability to withdraw up to $2000 or it’s equivalent daily. Here are all the features of the DOM account;

- There is no minimum opening or operational balance.

- The maximum cash withdrawal amount is $2,000. A withdrawal fee of 0.05 percent of transaction value, up to $10 per transaction.

- No cash deposits are permitted.

- Access to a USD Mastercard Debit Card for online dollar payments/subscriptions and withdrawals from ATMs across the world.

- Upgrade to Wema Domiciliary Plus is possible with the submission of full KYC documentation.

- Allows for the formation of foreign currency investments via a fixed deposit or USD Goals on the ALAT by Wema app.

- Foreign currency cash withdrawals and transfers are available at all of our locations.

- The account can be upgraded to a Non-export Domiciliary or Domiciliary Plus account to allow for foreign currency cash deposits with the presentation of two relevant references and a utility bill.

How to Create an AlatByWema Domiciliary Account

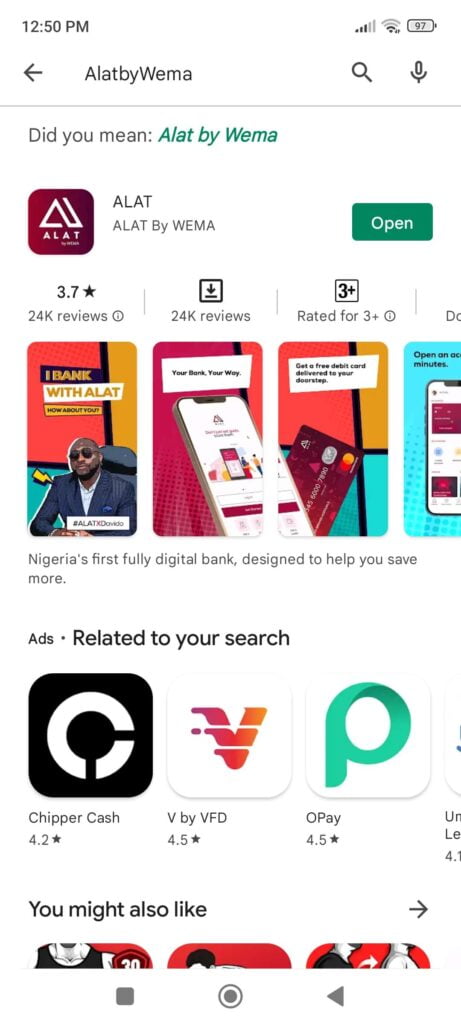

Step 1: Install the AlatbyWema App

To create a Wema Domiciliary account the first thing you will need to do is download and install the AlatByWema Application on your Android or iPhone. To do this,

- Visit the Google Play store and search for AlatByWema.

- Click on the first app that appears. The right app is the one in the image above.

- Install the app and then open it for the first time.

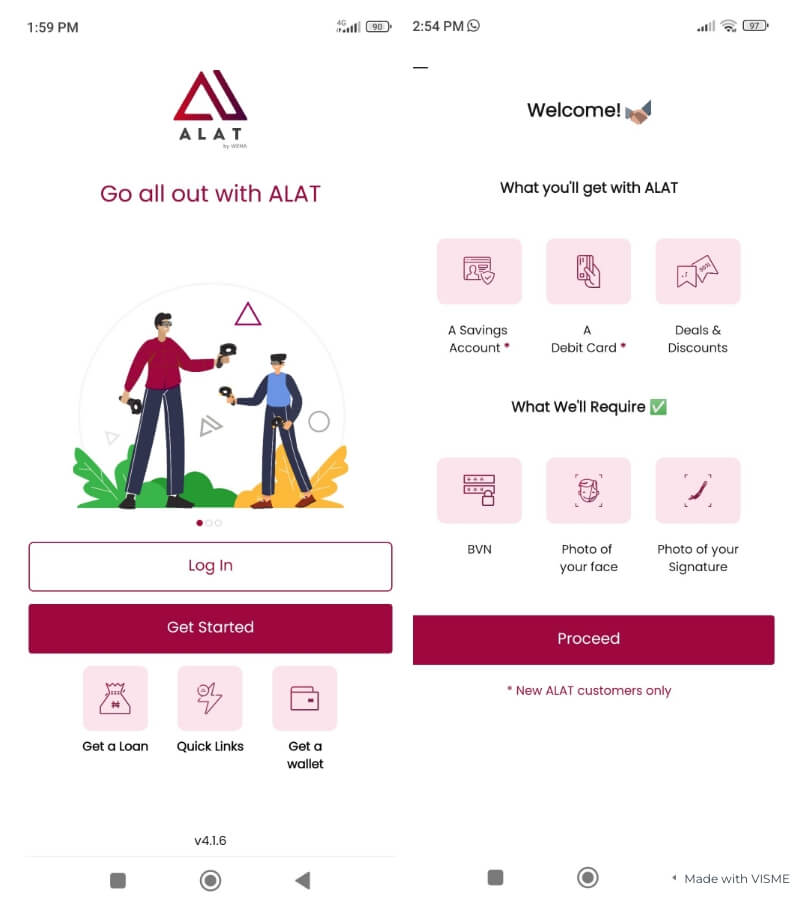

Step 2: Register for an Account

When you open the App for the first time, you will have to grant the app a few permissions to some necessary apps/information on your phone. Next, you will have to register for an account. To register for an account, follow the instructions below.

- Click on Get Started

- On the next page, you will be shown the requirements to open an account and what you will get with the app. Click on Proceed.

- Select your country of residence and then enter your Phone number and Email Address. Click on Proceed.

- On the next page, Enter your Bank verification number (BVN). Take a clear picture of your face and also take a clear picture of your signature. Make sure you sign on a blank page with no paper lining in order not to interfere with your signature. When you are done, click on verify identity.

- On the third page, you have to Enter your address information and also upload a snapped copy of the front and back of your identity card. When you are done, click on Complete.

When you are done, you will automatically be given a Wema Naira account and you can request a card. You will also have to wait for about a week for your information to be reviewed and accepted.

Also, you should make sure that all your information has been submitted and you should see 100% completed in your dashboard.

Step 3: Create a Dom Account

The DOM account feature will only be available after you have submitted all the necessary details and your information has been reviewed and passed.

To open your DOM account,

- Login to your account

- On your dashboard click on Create account

- Next, click on Domiciliary Account and then proceed as shown below.

- Select your preferred currency. You can choose a USD, EUR, or GBP account. Then click on Create an account.

Once you create the account, you will be provided with a domiciliary account within a minute. That’s just all you have to do to get a Domiciliary account in Nigeria without visiting the bank.

Final Thought

The Wema DOM account you just created should be more than enough for someone who makes not more than $5,000 a month. If there is any reason you want more functionality, like getting interested and many other features, you can upgrade to the Wema Dom Plus. But don’t forget you will have to provide two references. You can view your funds in transactions.

You will have to visit the bank to withdraw any funds from your account and also Exchange it on the black market. You can’t make a transfer on this account and you won’t be alerted when you receive funds in the account. You will have to visit the app to see your funds.

If you have any questions about the Wema DOM account, feel free to ask me in the comments below and I will do well to respond to every comment.