iPesa Loan App

$0The iPesa loan app is great for anyone looking to get a payday or business loans. The loan app can also be used to send, receive and make bill payments. Just install the app, sign up, and you’re in business—no need to visit a bank or fill out endless paperwork. iPesa’s got your back with quick loan approvals and disbursements straight into your M-Pesa or bank account. The short-comings of the app is that the interest rate is high.

iPesa, provided by Risine Credit Limited, a company passionate about financial services, offers short-term loans directly from your smartphone. This is your go-to mobile lending solution in Kenya and other regions where it operates. Think of it as your friendly neighborhood digital lender. What’s the deal with iPesa? It’s a financial lifeline when you need quick cash to cover unexpected expenses or seize an opportunity.

The iPesa loan app has a 3.9 / 5.0 rating in the Google Play store, with over 28,200 favorable comments and over 5,000,000 downloads as of the time of writing. This Google review is the average you will get from most loan platforms.

You can borrow as much as Ksh 10,000, with a good interest rate. But these loans typically come with short repayment periods and interest rates, so it’s essential to use them wisely. Borrow responsibly, make those repayments on time, and you might even boost your credit score.

The rest of this article explains how to sign up and get your first loan from iPesa, the interest rate, the loan limit, requirements, the repayment period, and many other details you need to know about the app.

iPesa Loan Requirement

Before you can apply for a loan, you need to meet some basic requirements, which will guarantee that your loan will be disbursed to you. Below are the basic requirements for iPesa Loan;

- Age: Borrowers are usually required to be at least 18 years old to apply for iPesa loans.

- Kenyan National ID: A valid Kenyan national identification card (ID) is required for identity verification.

- Safaricom Phone Number: You will need to provide a Safaricom phone number. To make your loan request faster, provide the Safaricom phone number linked with your M-Pesa account.

- M-Pesa Account: Having an active M-Pesa account linked to your mobile phone number is necessary for loan disbursements and repayments. iPesa will only disburse loans to the M-Pesa bank account.

- Smartphone: You need an Android smartphone with internet access to download the iPesa app and apply for loans. The loan app is not available for iOS users.

How to Apply For an iPesa Loan

To apply for an iPesa loan in Kenya, follow these general steps:

Always borrow responsibly and consider your ability to repay before taking out a loan.

iPesa USSD Code

Unfortunately, iPesa only offers loans to its users through its mobile app. They do not provide loans by dialing a USSD code. You can check out other loan platforms that offer loans via USSD codes.

iPesa Interest Rate

iPesa, like many other loan apps, typically charges interest rates on its loans. They do not specify the interest rate but, the specific interest rate can vary depending on several factors, including the loan amount, repayment term, your creditworthiness, and iPesa’s lending policies. These rates are subject to change, so it’s important to always check the interest you will be paying back before accepting a loan offer.

iPesa, however, specified that the minimum and maximum interest rate is 36% and 72% APR respectively. An annual percentage rate (APR) of 36% indicates that if you are to take a loan for a full year, the loan repayment will increase by approximately 36% due to accrued interest. For instance, if you borrowed Ksh 1,000 from iPesa with a 12-month repayment period, the interest to be paid will amount to around Ksh 360. But the loans on iPesa do not take up to a year.

Using a case study, we can investigate iPesa interest rate. Njeri borrowed Ksh 5,000 for a loan period of three months. She is to pay back Ksh 2,040.70 monthly. From this information, we can calculate iPesa monthly interest rate for a three-month loan term.

Total amount to be repaid = 2040.70 x 3 = Ksh 6122.1

Interest = Amount repaid – Amount Borrowed

Interest = 6122.1 – 5000 = Ksh 1,122.1

Monthly interest = 1122.1/3 = Ksh 374

Monthly interest Rate = Interest/loan amount X 100%

Monthly Interest Rate = 374/5000 X 100% = 7.4%

Therefore, iPesa Monthly interest rate for this particular loan is 7.4%. We can say that iPesa’s monthly interest ranges from 4.5% – 13.5%.

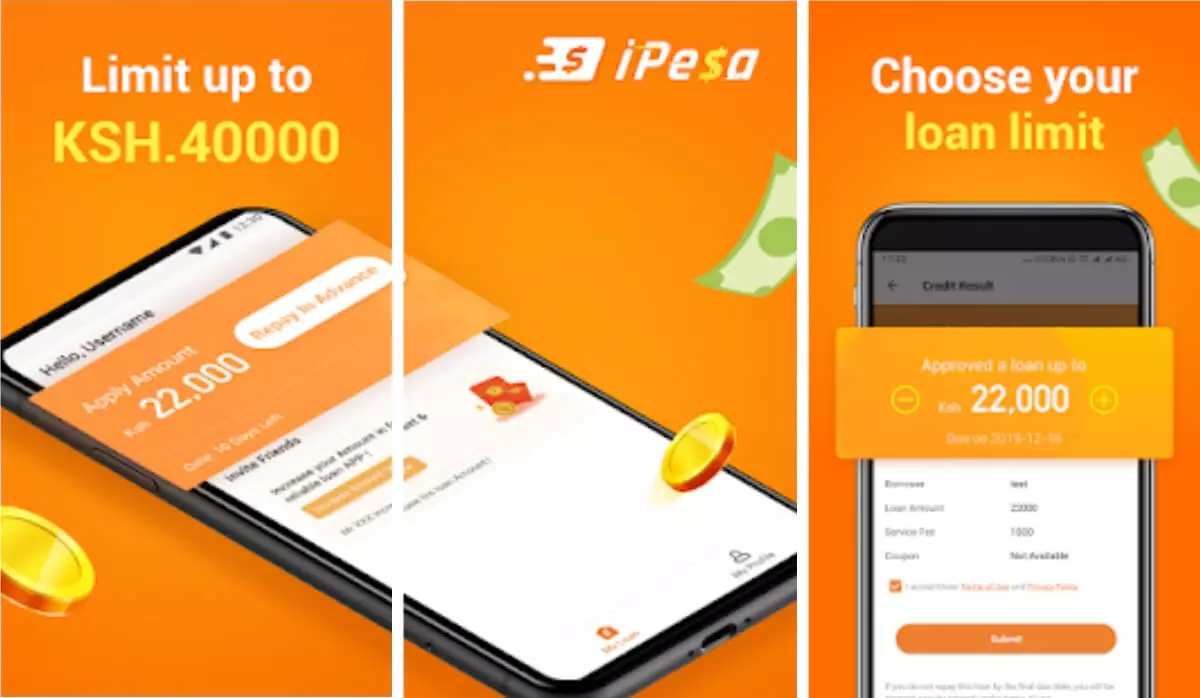

iPesa Loan Amount Limit

iPesa typically offers varying loan limits to borrowers based on several factors, including your creditworthiness, repayment history, and the information you provide during the loan application process.

iPesa may initially provide lower loan limits to new borrowers to assess their creditworthiness. However, borrowers who demonstrate responsible repayment behavior and build trust with the platform may become eligible for higher loan limits over time.

But overall, the minimum amount that can be borrowed from iPesa is Ksh 500 and the maximum offer is Ksh 50,000.

Duration of iPesa Repayment

The Ipesa loan repayment period is determined by iPesa algorithm using some metrics like your loan amount. You will be given a list of periods you are willing to pay the amount back. You should know that the longer the period you choose to pay back, the higher the interest to be paid. The maximum loan duration for loans on iPesa is 180 days.

Penalties for iPesa Loan Late payments

When borrowers fail to make loan payments on time, they will incur additional charges or penalties, which include;

- Increased Interest Charges: iPesa will apply 2% additional interest or penalty interest to the outstanding balance for each day your payment is late. This can significantly increase the total cost of the loan.

- Negative Impact on Credit Score: Late payments can negatively affect your credit score, potentially making it more challenging to access credit in the future.

How to Repay iPesa Loan Via M-Pesa

To repay an iPesa loan using M-Pesa, follow these steps:

- Check Your Loan Details: Open the iPesa app and log in to your account. View your active loan details, including the outstanding balance and due date.

- Ensure Sufficient M-Pesa Balance: Make sure you have enough funds in your M-Pesa account to cover the loan repayment amount.

- Dial M-Pesa USSD Code: On your mobile phone, dial the M-Pesa USSD code (*150# for Safaricom users in Kenya). Press the call button to initiate the M-Pesa menu.

- Select “Lipa Na M-Pesa” (Pay with M-Pesa): In the M-Pesa menu, select “Lipa na M-Pesa” or “Pay with M-Pesa.”

- Choose “Pay Bill”: Next, select “Pay Bill” to make a payment to iPesa.

- Enter the iPesa Pay Bill Number: Enter iPesa’s Pay Bill number 192010.

- Enter Your Phone Number as the Account Number: In the “Account Number” or “Reference” field, enter your own mobile phone number, which is often used as your iPesa account number.

- Enter the Loan Repayment Amount: Enter the specific amount you wish to repay toward your iPesa loan.

- Enter Your M-Pesa PIN: You will be prompted to enter your M-Pesa PIN to confirm the payment.

- Confirm the Payment: Review the details of the payment to ensure accuracy. Confirm the payment by entering your M-Pesa PIN again.

- Payment Confirmation: After a successful payment, you should receive a confirmation message from M-Pesa indicating that the payment has been completed.

- iPesa Loan Status Update: Check your iPesa loan status in the app to confirm that the outstanding balance has been reduced to reflect the repayment.

Always make sure to repay your iPesa loan on time to avoid late payment fees and additional interest charges. If you encounter any difficulties or have questions about making loan repayments, you can contact iPesa’s customer support for assistance.

iPesa Loan Overpayment

When repaying your loan, if you made a payment more than the intended amount, the iPesa loan app will refund the excess money to your M-Pesa account within 15 days after all payments have been reconciled.

It’s important to carefully consider your financial situation and ability to repay before using iPesa or any similar lending platform. Make sure you fully understand the terms and costs associated with the loan, and only borrow what you genuinely need and can comfortably afford to repay within the specified timeframe.

iPesa Loans Contacts

- Website: https://ipesa.cc/home

- Email: [email protected]